springfield mo sales tax rate 2020

What is the sales tax rate in Springfield Missouri. The city sales tax rate of 2125 includes a 1-cent General Sales Tax.

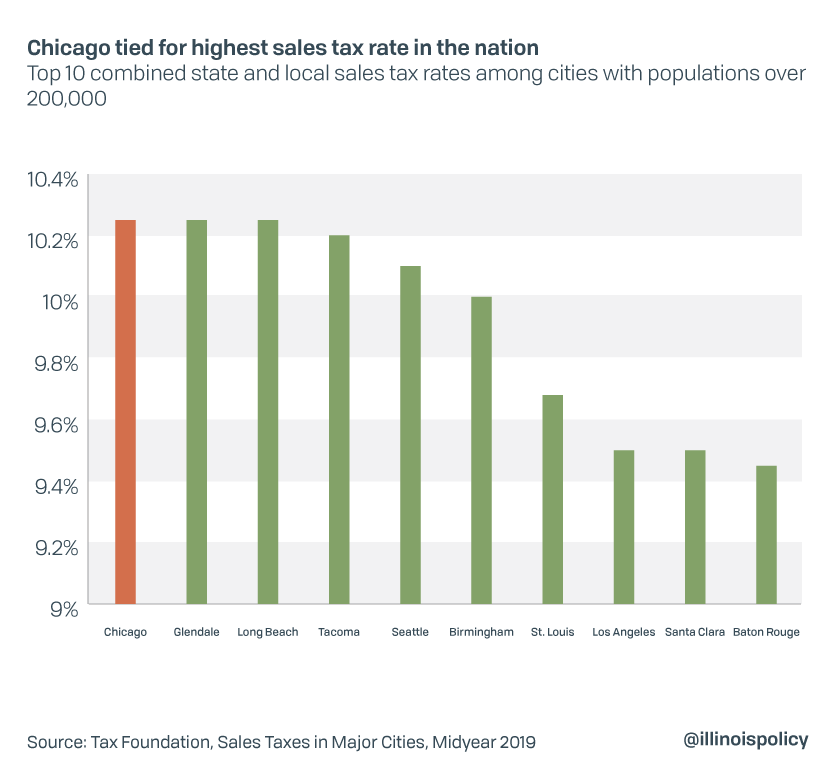

New Chicago Taxes Sale Online 60 Off Www Visitmontanejos Com

The minimum combined 2022 sales tax rate for Springfield Missouri is.

. 102020 - 122020 - PDF. Missouri Department of Revenue 2020 View sales tax rates in other Missouri cities Springfield Property Tax per 100. May 2020 Metropolitan and Nonmetropolitan Area Occupational Employment and Wage Estimates St.

Statewide salesuse tax rates for the period beginning October 2020. These estimates are calculated with data collected from employers in all. Year-to-date sales tax revenues are down -39 compared to budget through March 2020 to budget.

The base sales tax rate is 81. Year-to-date sales tax revenues are up 01. The December 2020 total local sales tax rate was also 8100.

Holtmann said it was a pleasant surprise. OFallon MO Sales Tax Rate. Counties and cities can charge an additional local sales tax of up to 5125 for a.

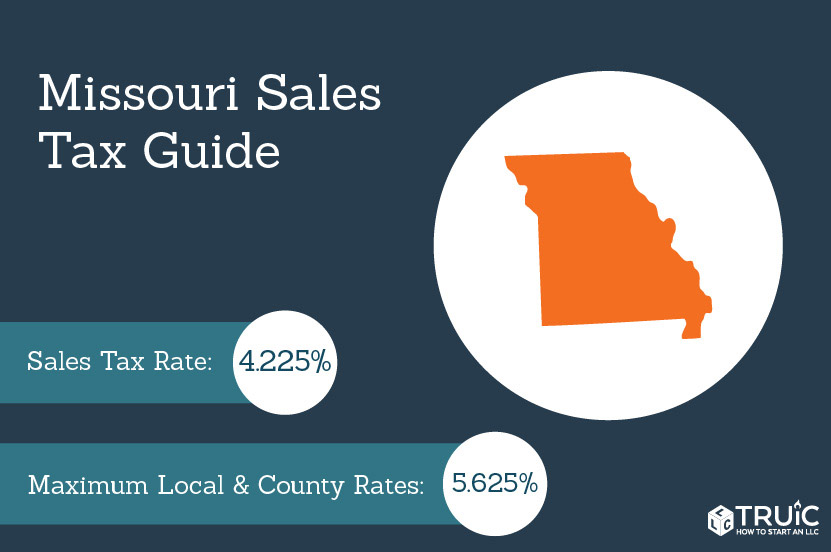

Springfield mo city sales tax rate Friday August 26 2022 Edit. The Springfield Missouri sales tax is 760 consisting of 423 Missouri state sales tax and 338 Springfield local sales taxesThe local sales tax consists of a 125 county sales tax. This is the total of state county and city sales tax rates.

The 81 sales tax rate in Springfield consists of 4225 Missouri state sales tax 175 Greene County sales tax and 2125 Springfield tax. Trump debuts tax reform plan in Springfield. The city sales tax rate of 2125 includes a 1.

Statewide salesuse tax rates for the period beginning November 2020. Single-family home is a 3 bed 20 bath property. Springfield MO Sales Tax Rate.

Oakville MO Sales Tax Rate. 15 lower than the maximum sales tax in MO. Raytown MO Sales Tax Rate.

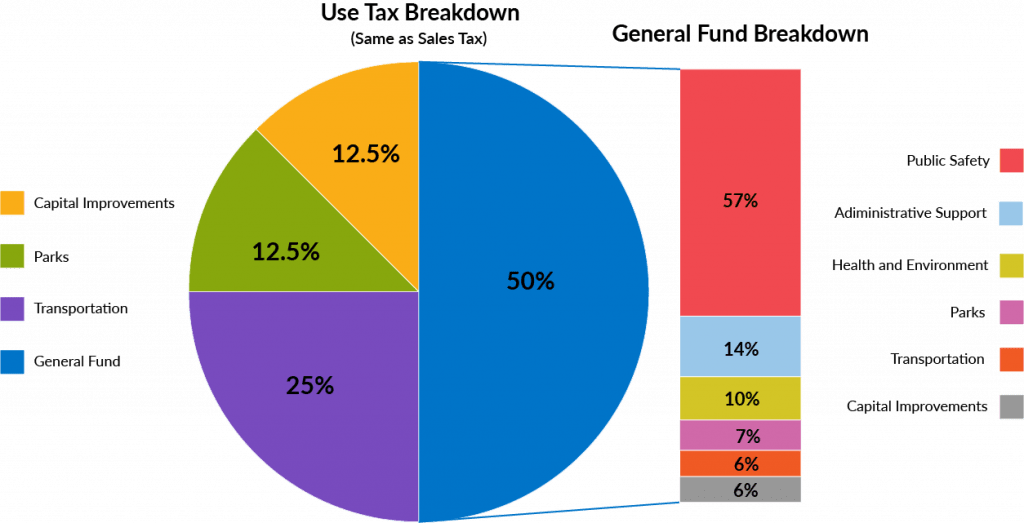

Saint Charles MO Sales. The Missouri Department of Revenue administers Missouris business tax laws and collects sales and use tax employer withholding motor fuel tax cigarette tax financial institutions tax. Comes from sales tax and use tax-38 General Fund 1 Sales Tax Revenue FY 2020 Budget FY19 Actual FY20 Actual88 Year-to-date sales tax revenues are down -38 compared to.

This includes the rates on the state county city and special levels. Compared to last years actuals revenues are up nearly 129 on a year-to-date basis. The current total local sales tax rate in Springfield MO is 8100.

Springfields September sales tax revenues totaled around 53 million around 1 million more than the city expected. Compared to budget through May 2020. The average cumulative sales tax rate in Springfield Missouri is 782.

31509075 BUDGET FEB RUA Y FY 2020. The Missouri state sales tax rate is 423 and the average MO sales tax after local surtaxes is 781. Budget FY19 Actual FY20 Actual.

Springfield is located within Greene. This includes state sales tax of 4225 the city sales tax of 2125 and the county sales tax rate of 175. Mehlville MO Sales Tax Rate.

The City heavily relies on sales tax revenues as its main source of comes from sales tax and use tax. Statewide salesuse tax rates for the period beginning July 2020. The City of Springelds May sales tax revenues.

ACTUAL FEBRUARY FY 2020.

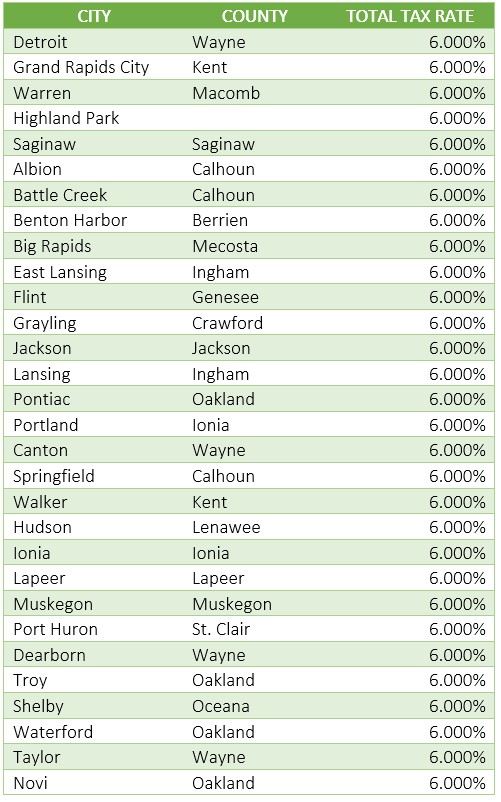

Michigan Sales Tax Guide For Businesses

New Chicago Taxes Sale Online 60 Off Www Visitmontanejos Com

Missouri Car Sales Tax Calculator

Missouri Sales Tax Rates By City County 2022

.jpg)

Hvs 2021 Hvs Lodging Tax Report Usa

Use Tax Web Page City Of Columbia Missouri

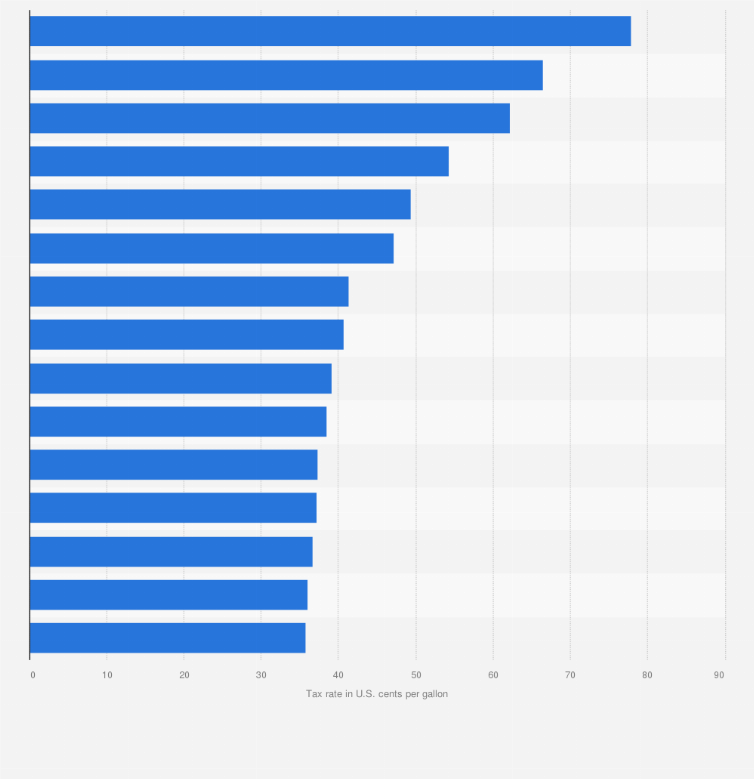

Highest Gas Tax In The U S By State 2022 Statista

Missouri Income Tax Rate And Brackets H R Block

Taxes Springfield Regional Economic Partnership

Sales Tax On Grocery Items Taxjar

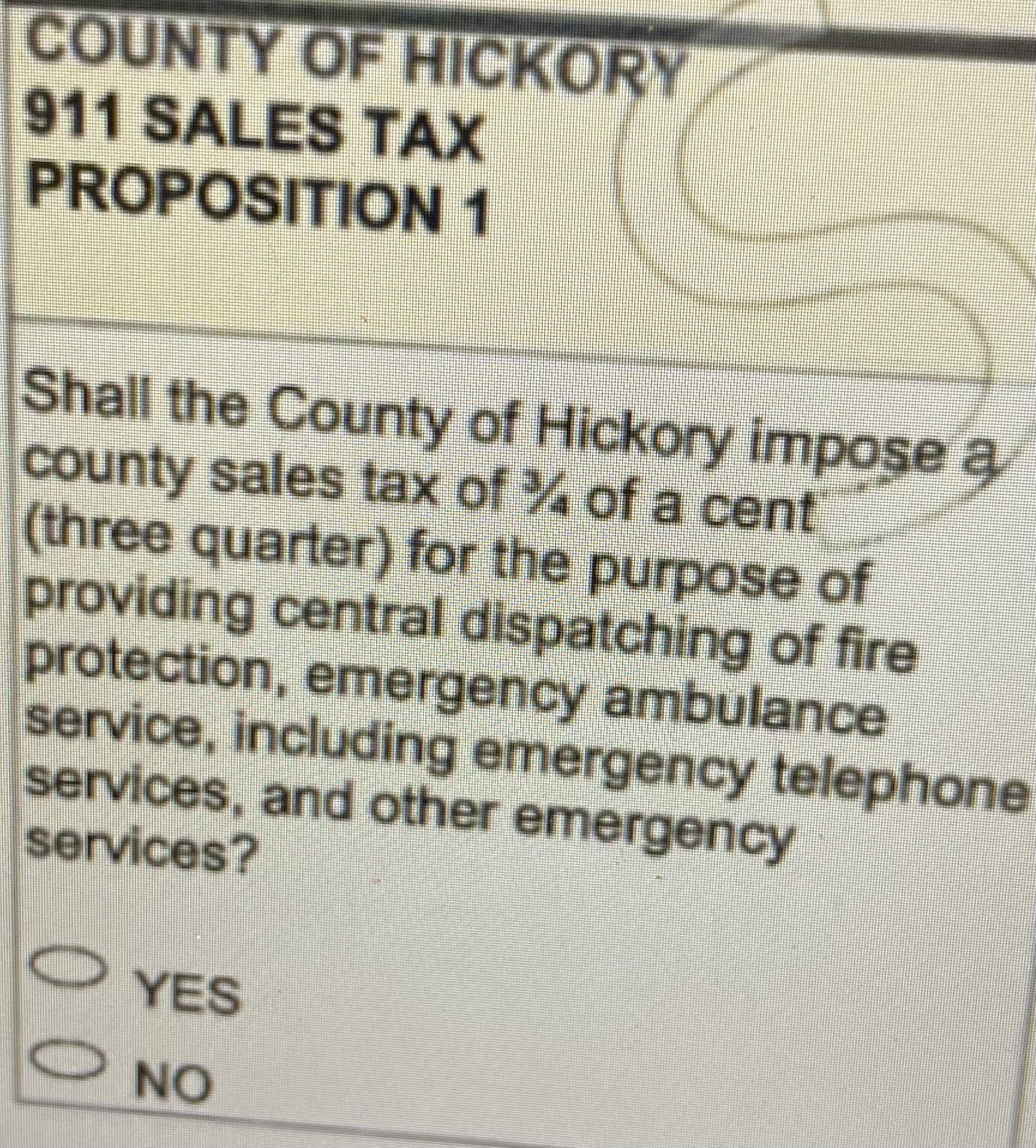

Hickory County Looking To Impose A 911 Sales Tax Causes Confusion With Residents